Choosing a reliable plush wholesale supplier is not about finding the lowest price or the fastest reply. From my experience working with retailers, distributors, and brand owners, reliability shows up over time and at scale—especially when orders repeat, volumes grow, and markets expand.

Wholesale cooperation puts long-term pressure on a supplier’s systems. Small weaknesses in experience, product scope, or production stability may not appear in the first order, but they surface quickly as SKUs increase and delivery cycles tighten.

That is why the right evaluation starts with fundamentals. Before reviewing pricing or lead times, buyers should first understand whether a supplier’s manufacturing experience and product range are truly suited for long-term wholesale supply.

What Manufacturing Experience and Product Range Indicate a Reliable Wholesale Supplier?

Manufacturing experience is one of the strongest predictors of wholesale reliability. From my experience, suppliers who have spent years producing plush toys at scale develop repeatable processes, not just attractive samples.

The first indicator is category focus. Reliable wholesale suppliers can clearly explain which plush categories they specialize in—such as animals, characters, promotional plush, or seasonal items—and how long they have produced them. Broad claims without depth often signal trading companies or unstable production partners.

Product range matters, but not in isolation. A strong supplier offers a coherent range that shares similar materials, construction methods, and quality standards. This allows consistent output across SKUs and easier scaling for wholesale buyers.

Experience with repeat orders is also critical. Wholesale reliability comes from handling ongoing replenishment, not one-off projects. Suppliers should be able to discuss how they manage consistency across batches, seasons, and production cycles.

Another key signal is problem history awareness. Experienced suppliers openly discuss past challenges—material shortages, peak season pressure, or quality issues—and how their systems evolved to prevent recurrence. This transparency reflects operational maturity.

Finally, manufacturing depth matters more than showroom variety. Suppliers with in-house sampling, pattern making, and stable production teams are better positioned to support wholesale growth than those relying heavily on outsourcing.

| Evaluation Factor | Weak Supplier Signal | Reliable Wholesale Signal | Buyer Benefit |

|---|---|---|---|

| Category experience | Vague or generic | Clear specialization | Better consistency |

| Product range | Random assortment | Structured, related SKUs | Easier scaling |

| Order history | One-off focus | Repeat wholesale orders | Stable supply |

| Process maturity | Avoids past issues | Explains improvements | Lower risk |

| Production depth | Heavy outsourcing | In-house core processes | Better control |

For buyers, evaluating experience and product range is about predictability. Suppliers who know their categories deeply and manage a focused range are far more reliable when wholesale volumes increase and timelines tighten.

How Do Quality Control Systems and Consistency Standards Affect Wholesale Reliability?

In wholesale supply, reliability is measured by how well quality holds up over repeated orders, not by how good the first sample looks. From my experience, many suppliers can produce one good batch, but only a few can deliver the same quality level month after month.

The core difference lies in system-based quality control. Reliable wholesale suppliers operate with defined QC checkpoints—from incoming materials to in-process inspections and final checks. Quality is monitored continuously, not inspected only at the end.

Consistency standards are equally important. Wholesale suppliers should work with approved reference samples, tolerance limits, and clear workmanship rules. This prevents gradual quality drift when orders are produced by different lines, shifts, or teams.

Another key factor is defect feedback and correction. Strong suppliers track defect types, analyze root causes, and apply corrective actions across future orders. Weak suppliers fix issues order by order without improving the system.

Scaling volume increases risk. Reliable suppliers adjust QC intensity as order size grows—adding in-process checks, line audits, and cross-batch comparisons. This is critical for wholesale buyers who depend on uniformity across large quantities.

Transparency also matters. Suppliers who share QC reports, inspection findings, and improvement actions reduce surprises and build buyer confidence. Silence around quality is a warning sign, not reassurance.

| QC Aspect | Weak Wholesale Supplier | Reliable Wholesale Supplier | Buyer Advantage |

|---|---|---|---|

| QC structure | End-of-line only | Multi-stage QC | Early defect control |

| Consistency control | Visual judgment | Reference & tolerance-based | Uniform batches |

| Issue handling | Case-by-case fixes | Root-cause correction | Fewer repeats |

| Volume scaling | Same QC for all sizes | QC adjusted to volume | Stable quality |

| Transparency | Limited visibility | Shared QC data | Predictable outcomes |

For wholesale buyers, strong QC systems are not a cost—they are insurance. Suppliers who invest in consistency standards and scalable quality control protect your brand as order volumes and market exposure grow.

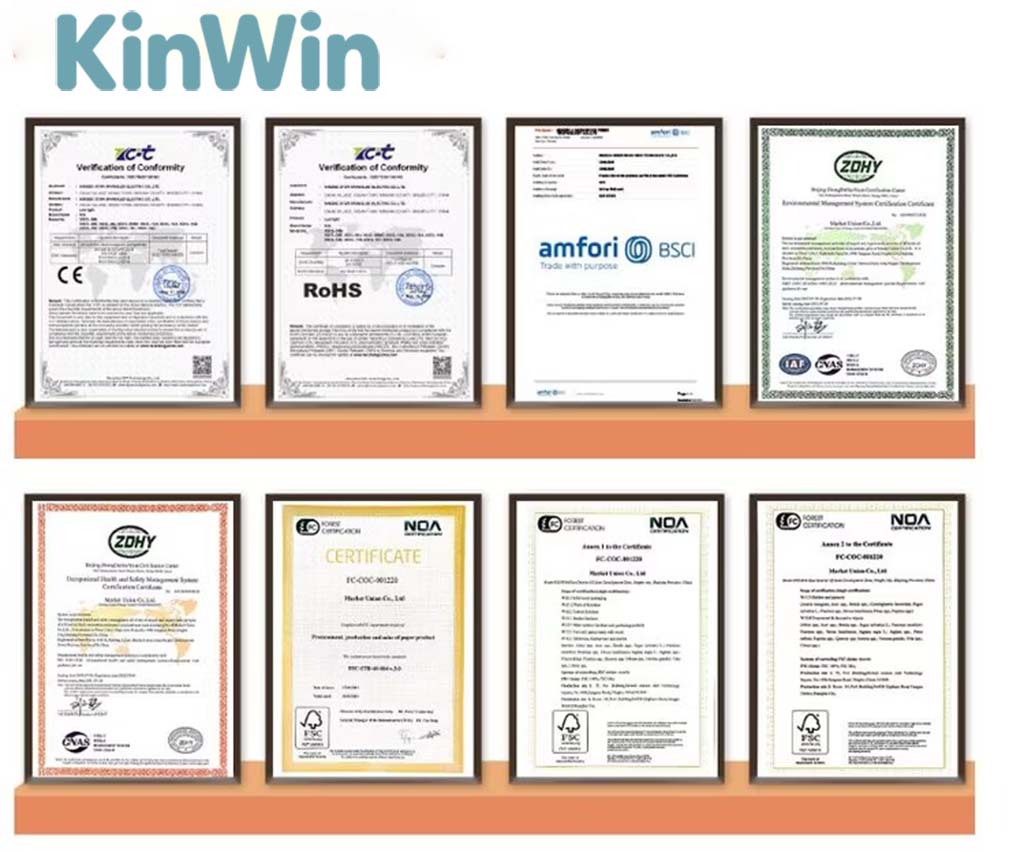

What Safety Certifications and Compliance Capabilities Are Essential for Wholesale Supply?

For wholesale plush supply, safety and compliance are not one-time checks—they are ongoing operational capabilities. From my experience, suppliers become unreliable when compliance is treated as a document request instead of a managed system.

The first requirement is market-specific certification readiness. Reliable wholesale suppliers clearly understand which certifications apply to which markets—such as CE/EN71 for the EU and ASTM/CPSIA for the U.S.—and can explain how they maintain compliance across repeat orders. Vague answers or “we can test if needed” usually indicate reactive compliance.

Material control is another essential capability. Suppliers must manage approved material lists, batch traceability, and restricted substance controls. Wholesale reliability depends on ensuring that materials used today match those tested previously. Uncontrolled material substitution is a major compliance risk at scale.

Documentation discipline separates reliable suppliers from risky ones. Strong suppliers maintain organized test reports, conformity declarations, supplier declarations, and labeling records. This allows buyers to respond quickly to audits, platform requirements, or regulatory inquiries without delaying shipments.

Testing strategy also matters. Reliable suppliers advise when full testing is required versus when periodic or change-based testing is sufficient. Over-testing wastes time and cost; under-testing creates exposure. Balanced guidance shows experience.

Finally, compliance transparency builds confidence. Suppliers who proactively flag regulatory updates or potential risks help buyers stay compliant as markets evolve—especially important for long-term wholesale programs.

| Compliance Capability | Weak Supplier Signal | Reliable Wholesale Signal | Buyer Protection |

|---|---|---|---|

| Market knowledge | Generic answers | Market-specific clarity | Correct certification |

| Material control | Flexible substitutions | Approved material lists | Compliance continuity |

| Documentation | On request only | Organized & ready | Faster approvals |

| Testing strategy | Test every order / none | Risk-based testing | Cost & time balance |

| Regulatory awareness | Reactive | Proactive updates | Long-term stability |

For wholesale buyers, compliance capability is about predictability under repetition. Suppliers who manage safety and certifications as systems—not favors—are far more reliable partners as volumes and market exposure increase.

How Do Pricing Transparency, MOQs, and Scalability Support Long-Term Wholesale Orders?

In wholesale cooperation, pricing is not just a number—it is a structure. From my experience, unreliable suppliers often create problems not by raising prices, but by failing to explain how pricing works as volumes change.

Pricing transparency is the first signal of reliability. Strong wholesale suppliers can clearly break down what drives cost—materials, labor, packaging, and volume efficiency. They explain why prices decrease at certain quantities and where further reductions are unrealistic. Hidden or constantly changing pricing erodes trust quickly.

MOQs play a critical role in scalability. Reliable suppliers offer reasonable entry MOQs that allow buyers to test markets, while also defining clear paths to higher volumes and better pricing. Extremely high MOQs at the start often signal inflexible production or cash-flow pressure on the supplier.

Scalability matters most over time. Long-term wholesale partners can explain how they handle volume growth—whether through additional lines, workforce expansion, or material sourcing capacity. Buyers should understand not just current capacity, but how capacity scales without harming quality or lead time.

Another key factor is price stability. Frequent price fluctuations—especially without clear justification—create planning problems for wholesale buyers. Reliable suppliers aim for stable pricing over defined periods and communicate early when adjustments may be needed.

Finally, pricing discussions should reflect partnership, not pressure. Suppliers who see long-term value are more willing to align pricing structures with forecasted growth instead of negotiating each order in isolation.

| Pricing Factor | Risky Supplier Practice | Reliable Wholesale Practice | Buyer Benefit |

|---|---|---|---|

| Price clarity | One-line quotes | Cost-based explanation | Budget confidence |

| Entry MOQ | Very high upfront | Flexible starting MOQ | Lower trial risk |

| Volume scaling | Unclear capacity | Defined scaling plan | Growth readiness |

| Price stability | Frequent changes | Period-based stability | Easier planning |

| Negotiation style | Order-by-order | Forecast-aligned | Long-term savings |

For wholesale buyers, transparent pricing and scalable MOQs create predictable growth paths. Suppliers who explain their pricing logic and scaling capabilities are far more reliable as partners over multiple order cycles.

What Communication Efficiency and Order Management Practices Reduce Wholesale Risks?

In wholesale cooperation, risk is rarely caused by one big failure. From my experience, most problems come from slow communication, unclear ownership, or fragmented order management. Reliable suppliers reduce risk by making communication and order handling predictable and structured.

The first indicator is response efficiency with substance. Fast replies matter, but clarity matters more. Strong wholesale suppliers confirm key points—specs, quantities, timelines, and next steps—in writing. This avoids misunderstandings and repeated corrections during production.

Order management structure is equally important. Reliable suppliers assign clear internal responsibility for sampling, production, QC, and shipping. Buyers should know who owns each stage and how information flows internally. When ownership is unclear, problems get delayed or ignored.

Another critical practice is order confirmation discipline. Professional suppliers issue detailed order confirmations covering specifications, packaging, delivery terms, and compliance scope. This document becomes the execution reference and reduces reliance on email history.

Progress visibility also reduces risk. Wholesale buyers benefit from scheduled updates—production status, inspection timing, and shipment readiness—rather than chasing information. Predictable reporting builds confidence and allows early intervention when needed.

Finally, escalation paths matter. Reliable suppliers define how issues are raised and resolved. Knowing when and how to escalate prevents small issues from becoming shipment-level problems.

| Management Practice | Weak Supplier Signal | Reliable Wholesale Practice | Buyer Benefit |

|---|---|---|---|

| Communication speed | Slow or vague | Fast & confirmed | Fewer misunderstandings |

| Responsibility clarity | No clear owner | Defined stage owners | Faster resolution |

| Order confirmation | Informal emails | Formal confirmation doc | Execution accuracy |

| Progress reporting | On request only | Scheduled updates | Early risk control |

| Escalation process | Undefined | Clear escalation path | Issue containment |

For wholesale buyers, efficient communication and disciplined order management turn suppliers into predictable operators, not constant follow-ups. These practices significantly reduce risk as order volume and frequency increase.

How Can Logistics Support, Lead Time Control, and After-Sales Service Strengthen Cooperation?

In wholesale supply, reliability is proven at the final mile. From my experience, even strong production performance can be undermined by weak logistics coordination or unclear after-sales responsibility. Long-term cooperation depends on end-to-end control, not just manufacturing.

Logistics support starts with lead time realism. Reliable wholesale suppliers quote lead times based on actual capacity, material availability, and shipping constraints—not optimistic assumptions. They explain each stage clearly so buyers can plan inventory and promotions with confidence.

Lead time control also requires buffer management. Strong suppliers build reasonable buffers for inspections, customs clearance, and transport variability. They communicate early if risks appear and propose alternatives—partial shipments, route changes, or adjusted schedules—before deadlines are missed.

After-sales service is often overlooked but critical for long-term trust. Reliable suppliers define how issues are handled after delivery—missing cartons, transit damage, or quality claims. Clear processes and response timelines reduce friction and prevent small issues from escalating.

Another key element is documentation accuracy. Correct packing lists, invoices, labels, and shipping marks reduce customs delays and warehouse confusion. Suppliers who double-check documents protect buyers from downstream disruptions.

Finally, proactive support matters. Suppliers who track shipments, confirm delivery, and follow up demonstrate ownership beyond the factory gate—strengthening cooperation over time.

| Support Area | Weak Supplier Practice | Reliable Wholesale Practice | Buyer Advantage |

|---|---|---|---|

| Lead time quoting | Optimistic dates | Stage-based realism | Better planning |

| Buffer management | No contingency | Built-in buffers | On-time arrivals |

| After-sales handling | Case-by-case | Defined process | Faster resolution |

| Documentation | Last-minute prep | Pre-checked accuracy | Smooth customs |

| Shipment follow-up | No tracking | Proactive updates | Peace of mind |

For wholesale buyers, strong logistics and after-sales support complete the reliability picture. Suppliers who manage delivery and post-delivery responsibly become true long-term partners, not just manufacturers.

Conclusion

A reliable plush wholesale supplier combines experience, systems, transparency, and execution. When these align, wholesale sourcing becomes stable, scalable, and brand-safe.

📧 Contact: [email protected]

🌐 Visit: https://kinwintoys.com