From my experience working with global buyers, the difference between popular plush toy manufacturers and average suppliers is not exposure or pricing—it is performance consistency over time. Popular manufacturers are repeatedly chosen, recommended, and trusted because they reduce uncertainty for buyers.

Many suppliers can complete one order. Far fewer can handle growing volumes, tighter timelines, multiple SKUs, and higher compliance expectations—without quality drifting or communication breaking down. Buyers remember which factories make their work easier and which create friction.

What truly sets top manufacturers apart is a combination of manufacturing capability, system maturity, and scalability discipline. The first and most visible difference starts with production capability and scale.

What Manufacturing Capabilities and Scale Separate Top Plush Factories from Basic Suppliers?

Manufacturing capability is the foundation that separates popular plush factories from basic suppliers. From my experience, top factories are not defined by how big they look—but by how well they scale without chaos.

The first difference is real, usable capacity. Popular manufacturers can clearly explain how many production lines they operate, what each line handles, and how capacity is allocated when multiple orders run at the same time. Average suppliers often quote theoretical output without explaining constraints.

Next is process completeness. High-performing factories control key production stages in-house—cutting, sewing, stuffing, finishing, and packing. This allows tighter quality control and faster issue resolution. Basic suppliers rely heavily on subcontracting, which increases variability as volume grows.

Equipment readiness also matters. Popular manufacturers invest in the right machines for embroidery accuracy, cutting precision, safety testing, and packaging efficiency. More importantly, they maintain equipment and plan upgrades based on order mix—not just cost.

Another key difference is scale experience. Top factories understand that scaling is not linear. They plan labor allocation, line balancing, and shift management to maintain consistency across large batches and repeat orders.

Finally, popular manufacturers are honest about limits. They protect performance by saying no to unrealistic timelines or volumes—while average suppliers often overpromise and underdeliver.

| Capability Area | Average Supplier Signal | Popular Manufacturer Signal | Buyer Advantage |

|---|---|---|---|

| Capacity clarity | Vague output claims | Line-based capacity planning | Predictable delivery |

| Process control | Heavy outsourcing | In-house core processes | Stable quality |

| Equipment support | Basic sewing only | Purpose-fit machinery | Fewer bottlenecks |

| Scale experience | One-off large orders | Repeat high-volume runs | Reliable scaling |

| Capacity honesty | Overpromising | Realistic commitments | Lower risk |

For buyers, strong manufacturing capability and scalable systems are what turn a factory into a repeat-choice supplier. When production is controlled, transparent, and realistic, cooperation becomes easier—and that is why these factories stay popular.

How Do Design Support, Pattern Making, and Sampling Accuracy Create Competitive Advantage?

Competitive advantage in plush manufacturing often forms before production begins. From my experience, popular manufacturers win repeat orders because they help buyers make better decisions earlier—through strong design support, disciplined pattern making, and accurate sampling.

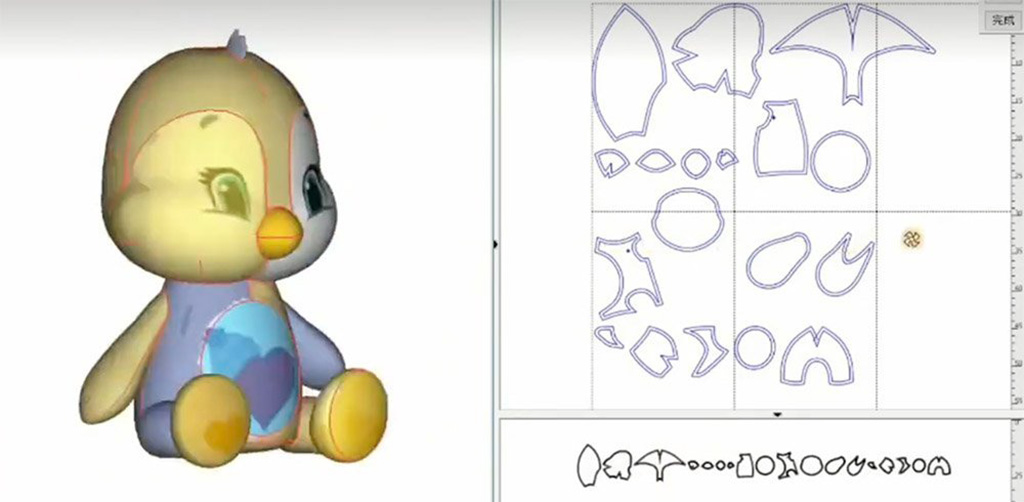

The first differentiator is design interpretation. Top manufacturers do not simply follow drawings; they translate intent into manufacturable structure. They advise on proportions, seam logic, material behavior, and durability risks. This reduces rework and shortens the path from concept to approval.

Pattern making then turns intent into structure. Skilled pattern teams maintain consistent body ratios, facial symmetry, and seam placement—especially across related SKUs. This consistency is critical for collections and brand recognition. Average suppliers often treat each style independently, leading to visible variation.

Sampling accuracy validates the system. Popular manufacturers aim for high first-pass accuracy, not speed alone. When revisions are needed, they are handled with clear summaries, updated specs, and version control. This discipline predicts how faithfully instructions will be followed at scale.

Another key advantage is production-realistic sampling. Samples are made with bulk-intended materials and methods, avoiding “sample room shortcuts.” This gives buyers confidence that approved samples can be reproduced on real lines.

Finally, restraint is a strength. Trusted manufacturers know when to recommend simplification to protect quality, cost, or repeatability—without compromising brand identity.

| Technical Area | Average Supplier | Popular Manufacturer | Competitive Advantage |

|---|---|---|---|

| Design support | Executes drawings | Manufacturability guidance | Fewer revisions |

| Pattern making | Style-by-style | Structural consistency | Cohesive products |

| Sampling accuracy | Multiple iterations | High first-pass match | Faster approvals |

| Revision control | Informal changes | Versioned updates | Clear execution |

| Scale awareness | Sample-only focus | Production-intent samples | Reliable scaling |

For buyers, these technical capabilities convert ideas into repeatable results. Manufacturers that control design, patterns, and sampling well reduce risk early—and that reliability is why they earn preference over average suppliers.

What Quality Control and Process Management Systems Define Consistent High Performers?

Consistent high performers in plush manufacturing are defined by process discipline, not by stricter final checks. From my experience, popular manufacturers design quality into every stage so results remain stable as volumes, SKUs, and timelines increase.

The first defining system is layered quality control. Top factories operate clear IQC (incoming materials), IPQC (in-process), and FQC (final inspection) stages with written standards and ownership. Average suppliers rely too heavily on final inspection, which is risky once defects scale.

Process management is equally critical. High performers use standard operating procedures (SOPs) for cutting accuracy, embroidery placement, stuffing balance, and finishing details. These SOPs reduce dependence on individual workers and protect output across shifts and lines.

Another key differentiator is reference-based execution. Popular manufacturers keep approved golden samples, workmanship guides, and measurement tolerances visible on the production floor. Inspectors and line leaders compare against physical references, not memory or photos.

Data closes the loop. Consistent factories track defects by type and root cause, apply corrective and preventive actions (CAPA), and verify improvements in subsequent runs. Without data, quality control becomes reactive and repetitive.

Finally, scalability separates leaders from followers. As order size grows, inspection frequency, line audits, and cross-line comparisons increase accordingly. Using the same QC intensity for small and large orders is a common failure point for average suppliers.

| System Area | Average Supplier Practice | High Performer Practice | Buyer Impact |

|---|---|---|---|

| QC structure | Final-only checks | IQC + IPQC + FQC | Early defect control |

| Process control | Skill-dependent | SOP-driven execution | Stable quality |

| Reference usage | Visual judgment | Golden samples on floor | Consistency |

| Data & CAPA | No trend tracking | Root-cause analysis | Continuous improvement |

| Scale adaptation | Same QC at all volumes | QC scales with volume | Reliable mass output |

For buyers, strong QC and process management systems are what make performance repeatable. Manufacturers that control quality through structure, references, and data are the ones that stay reliable—and popular—over time.

How Do Compliance Experience and Global Certifications Build Buyer Confidence?

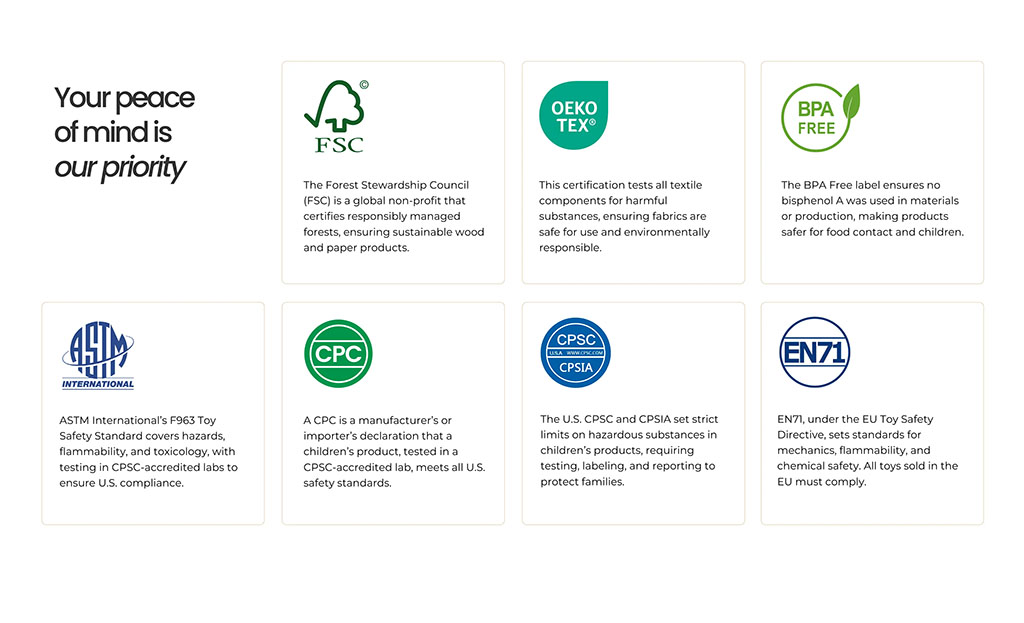

For global buyers, confidence is built on predictable compliance, not on certificates shown at the last minute. From my experience, popular plush toy manufacturers are trusted because they treat compliance as an operating system—not a checkbox.

The first differentiator is market-specific experience. High-performing factories can clearly explain which regulations apply to each target market and how those rules influence materials, construction, labeling, and documentation. Average suppliers often give generic answers that push risk downstream to the buyer.

Testing capability is the next trust builder. Popular manufacturers maintain stable testing workflows—either in-house or with long-term accredited labs. They understand timelines, costs, re-test triggers, and how changes affect validity. This predictability protects launch schedules.

Material compliance control further separates leaders from followers. Trusted factories manage approved material lists, supplier declarations, and batch traceability. This ensures mass production uses the same inputs that passed testing—reducing rework and shipment holds.

Documentation readiness also matters. High performers keep organized test reports, conformity declarations, and compliance records available on request. Buyers do not need to chase files or interpret incomplete reports.

Finally, change management preserves confidence over time. When fabrics, fillings, or accessories must change, popular manufacturers flag compliance impact early and require approvals before implementation.

| Compliance Area | Average Supplier | Popular Manufacturer | Buyer Confidence |

|---|---|---|---|

| Market knowledge | Generic guidance | Market-specific clarity | Correct planning |

| Testing workflow | Ad hoc labs | Stable testing partners | Predictable timing |

| Material control | Flexible substitution | Approved material lists | Test validity |

| Documentation | On request only | Organized & ready | Faster approvals |

| Change management | Silent changes | Approval-based process | Ongoing compliance |

For buyers, deep compliance experience and disciplined certification management remove uncertainty. Manufacturers who manage safety proactively earn trust—and that trust is why buyers return to them project after project.

What Communication, Responsiveness, and Project Ownership Distinguish Trusted Manufacturers?

Trusted plush manufacturers stand out by how they communicate under pressure, not just how fast they reply. From my experience, buyers stay with certain factories because coordination feels controlled, predictable, and respectful of timelines.

The first signal is structured communication. High-performing manufacturers confirm specifications, changes, and timelines in writing. They summarize decisions after calls and clearly outline next steps. Average suppliers rely on fragmented chat messages, which leads to confusion as projects scale.

Responsiveness must come with substance. Popular manufacturers reply quickly and resolve questions. They provide clear answers, data, or options—rather than acknowledgments without action. This keeps projects moving and reduces follow-up cycles.

Project ownership is another major differentiator. Trusted factories assign a dedicated project manager who coordinates sampling, production, QC, and logistics. Buyers know exactly who owns decisions and how issues escalate. Without ownership, delays multiply when volumes increase.

Transparency builds long-term trust. High performers share progress updates, QC findings, and risks proactively. They do not wait for buyers to discover issues. This “no surprises” approach reduces stress and protects launch plans.

Finally, continuity matters. Popular manufacturers document processes, approvals, and lessons learned so cooperation remains stable even if team members change.

| Collaboration Signal | Average Supplier | Trusted Manufacturer | Buyer Benefit |

|---|---|---|---|

| Communication | Ad-hoc messages | Written confirmations | Fewer errors |

| Responsiveness | Fast but vague | Fast & decisive | Shorter cycles |

| Project ownership | Unclear roles | Dedicated manager | Clear accountability |

| Transparency | Reactive updates | Proactive sharing | Predictable execution |

| Continuity | Person-dependent | Process-driven records | Stable cooperation |

For buyers, communication quality and ownership determine whether a factory feels like a partner or a risk. Manufacturers that manage information and responsibility well earn trust—and repeat business.

How Do Long-Term Partnership Mindsets Drive Innovation, Stability, and Brand Growth?

What truly separates popular plush toy manufacturers from average suppliers is a long-term partnership mindset. From my experience, factories that think beyond individual orders create more value for brands—through stability, continuous improvement, and shared growth.

The first difference is investment thinking. Trusted manufacturers invest in understanding a brand’s positioning, target markets, and growth plans. This allows them to propose better materials, construction methods, or cost optimizations that align with future needs—not just current price targets.

Innovation follows trust. When partnerships are stable, manufacturers feel confident suggesting new techniques, materials, or processes. These ideas often come from production experience and help brands improve quality, reduce costs, or differentiate products—without taking unnecessary risks.

Stability is another outcome. Long-term partners plan capacity, labor, and materials around repeat business. This reduces surprises during peak seasons and ensures consistent quality across reorders. Average suppliers treat every order as isolated, which increases volatility.

Problem-solving also improves over time. With shared history, issues are resolved faster because root causes are understood and preventive systems already exist. This protects brand reputation and internal efficiency.

Finally, growth becomes easier. Manufacturers who grow alongside brands can support volume increases, new collections, or market expansion without resetting processes each time. This scalability is a key reason buyers continue recommending certain factories.

| Partnership Mindset | Average Supplier | Popular Manufacturer | Brand Impact |

|---|---|---|---|

| Business view | Order-by-order | Long-term collaboration | Strategic alignment |

| Innovation | Reactive | Proactive suggestions | Product advantage |

| Stability | Short-term planning | Capacity & material planning | Predictable supply |

| Problem-solving | Issue-by-issue | System improvement | Lower risk |

| Growth support | Limited | Scalable cooperation | Sustainable expansion |

For buyers, a long-term partnership mindset turns manufacturers into growth enablers. These factories remain popular because they help brands move faster, safer, and more confidently over time.

Conclusion

Popular plush toy manufacturers stand apart through scalable capability, disciplined systems, global compliance, and partnership thinking—making them reliable choices as brands grow.

📧 Contact: [email protected]

🌐 Visit: https://kinwintoys.com