Developing a custom stuffed animal with an OEM partner is not a creative-only process—it is a structured product development workflow. From my experience working with brand owners and retail buyers, most OEM projects succeed or fail based on how well the early steps are prepared, not how fast production starts.

OEM partners are not just manufacturers. They translate ideas into manufacturable products under cost, safety, and time constraints. When buyers approach OEM development without clear preparation, projects often suffer from repeated revisions, unstable pricing, and delayed launches.

The first and most critical step is preparing clear design concepts and specifications before engaging an OEM partner. This stage sets the foundation for feasibility, cost control, and development efficiency across the entire project.

How to Prepare Design Concepts and Specifications Before Engaging an OEM Partner

Before contacting an OEM partner, buyers should treat design preparation as risk reduction, not just creativity. From my experience, OEM projects move faster and more accurately when buyers provide structured inputs instead of abstract ideas.

The starting point is design intent clarity. Buyers do not need perfect artwork, but they must define what matters most—character personality, target age group, size range, softness level, and market positioning. These elements guide OEM partners in making correct design and material decisions early.

Next is functional specification. This includes intended use (play, gift, promotion), safety age grading, expected durability, and any special features such as embroidery-only faces or removable accessories. Clear functional intent prevents OEM partners from making assumptions that later require correction.

Dimensional guidance is also important. Even approximate size targets help OEM teams assess pattern complexity, material consumption, and cost structure. Without size reference, cost and feasibility discussions remain vague.

Another key preparation step is market and compliance context. Buyers should clearly state target markets (U.S., EU, Japan, etc.) and expected safety standards. This allows OEM partners to propose compliant materials and constructions from the beginning, avoiding redesign later.

Finally, buyers should define decision priorities. Is cost more important than detail? Is speed more important than customization depth? OEM partners make trade-offs constantly. When priorities are unclear, misalignment increases.

| Preparation Area | Weak Buyer Input | Strong OEM-Ready Input | OEM Development Impact |

|---|---|---|---|

| Design intent | Abstract idea | Clear character & feel | Accurate interpretation |

| Functional use | Not defined | Use & age specified | Safer design choices |

| Size guidance | “Standard size” | Target dimensions | Feasible costing |

| Market context | Mentioned later | Defined upfront | Compliance-ready design |

| Decision priority | Unstated | Cost / quality balance | Fewer conflicts |

For buyers, strong preparation does not mean more documents—it means clear direction. When design concepts and specifications are prepared with OEM realities in mind, partners can respond with realistic plans, accurate cost evaluations, and smoother development from the very first step.

How OEM Feasibility Reviews and Cost Evaluations Shape the Development Plan

Once an OEM partner receives your design concepts and specifications, the next critical step is the feasibility review and cost evaluation. From my experience, this stage determines whether a project will be stable and scalable—or face repeated adjustments later.

A professional OEM feasibility review starts with manufacturability analysis. The OEM team evaluates pattern complexity, sewing difficulty, material availability, and potential risk points such as weak seams or unstable structures. This is not about rejecting ideas, but about identifying where design intent may conflict with production reality.

Cost evaluation follows feasibility, not the other way around. Reliable OEM partners break costs into material, labor, tooling, testing, and overhead components. This transparency helps buyers understand where costs come from and which elements can be optimized without compromising quality or safety.

Another key outcome of feasibility review is option comparison. Strong OEM partners propose alternative fabrics, constructions, or processes that meet the same design goals at different cost or lead-time levels. This gives buyers control over trade-offs instead of surprises.

Timeline feasibility is also assessed at this stage. OEM partners evaluate sampling time, testing lead time, and production windows based on current capacity. Unrealistic timelines are a common risk when feasibility reviews are skipped or rushed.

Most importantly, this step aligns expectations. When buyers and OEM partners agree on what is feasible, what is flexible, and what is fixed, the development plan becomes predictable.

| Feasibility Focus | Weak OEM Approach | Strong OEM Approach | Buyer Advantage |

|---|---|---|---|

| Manufacturability | “Can do” response | Risk-point analysis | Fewer redesigns |

| Cost breakdown | One-line quote | Itemized estimation | Budget control |

| Optimization options | No alternatives | Multiple solutions | Informed decisions |

| Timeline planning | Optimistic guess | Capacity-based plan | On-time launch |

| Expectation alignment | Assumptions | Documented agreement | Project stability |

For buyers, feasibility reviews are not a delay—they are a cost-saving and risk-reduction tool. OEM partners who invest time in structured feasibility and cost evaluation help ensure that development plans are realistic, aligned, and ready for the next step: turning concepts into physical samples.

How Pattern Making and Prototyping Turn Concepts into Physical Samples

Pattern making and prototyping are where ideas become reality—or where hidden risks surface. From my experience, this stage determines whether a concept can be reproduced consistently or remains a one-off sample.

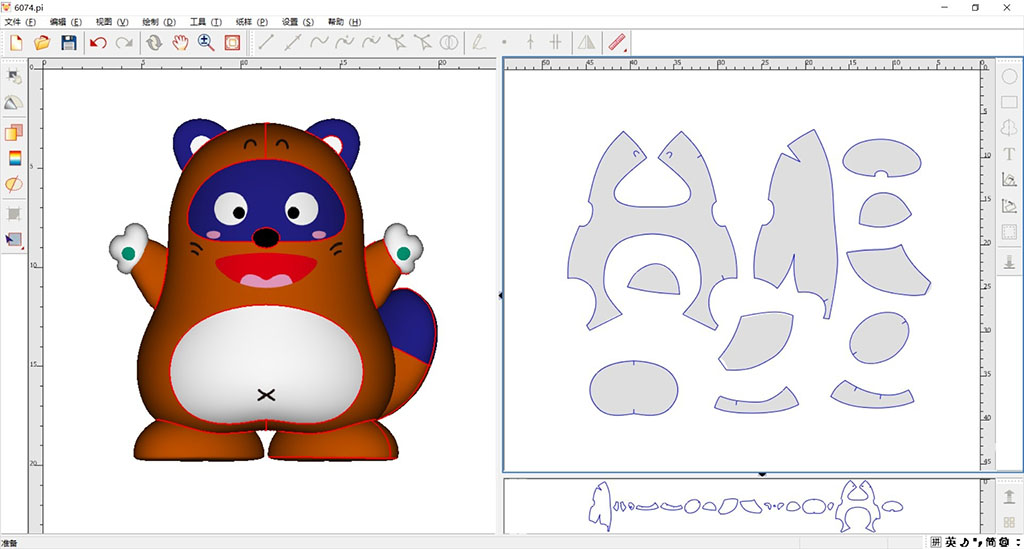

Professional pattern making begins with 3D interpretation, not tracing artwork. OEM teams translate character intent into volumes: head mass, body depth, limb rotation, and seam flow. This ensures balance and stability after stuffing, especially when using pile fabrics that magnify small errors.

Next comes prototype logic. Strong OEM partners build the first prototype to test structure, not to impress visually. They validate seam paths, stuffing distribution, and posture. If joints, accessories, or sound modules are planned, these are provisioned early to avoid late-stage redesigns.

Material behavior is assessed during prototyping. Fabrics stretch, pile lays differently, and embroidery density alters expression. Experienced OEM teams adjust patterns to account for these behaviors instead of compensating with overstuffing or manual fixes.

Equally important is documentation. Each prototype revision should result in updated patterns and notes—what changed, why it changed, and how it affects future production. This creates a clear bridge from sample approval to mass production.

Finally, repeatability checks matter. Producing two prototypes from the same pattern verifies whether results converge. Convergence signals control; divergence signals risk.

| Prototyping Aspect | Weak OEM Practice | Strong OEM Practice | Buyer Benefit |

|---|---|---|---|

| Pattern approach | Artwork tracing | Volume-based design | Stable structure |

| Prototype goal | Visual appeal | Structural validation | Fewer surprises |

| Material handling | Afterthought | Behavior-adjusted patterns | Accurate look & feel |

| Documentation | Verbal notes | Pattern & change logs | Production alignment |

| Repeatability | One-off success | Converging prototypes | Scale confidence |

For buyers, this stage is the first proof of OEM capability. OEM partners who prioritize structure, document changes, and validate repeatability set the project up for smooth revisions and reliable approval in the next step.

How Sample Revisions and Approvals Ensure Design Accuracy and Manufacturability

Sample revisions are not a sign of failure—they are a controlled learning process. From my experience, the quality of revision cycles says more about an OEM partner’s capability than the first prototype itself. Strong OEM partners use revisions to converge toward accuracy, not to endlessly “adjust.”

The first key factor is how feedback is translated. Professional OEM teams restate buyer comments in technical terms, confirm priorities, and explain which changes affect structure, cost, or lead time. This prevents misinterpretation and avoids fixing one issue while creating another.

Revision logic also matters. Effective revisions are targeted, not global. For example, adjusting facial proportion should not alter body volume unless required. OEM partners with weak control often rework multiple areas unnecessarily, causing instability between versions.

Approval standards must be clear. Buyers should approve samples against defined criteria: proportions, dimensions, materials, safety intent, and feel. OEM partners who help buyers formalize these criteria reduce future disputes and speed up sign-off.

Another critical element is revision traceability. Each approved change should be reflected in updated patterns, BOMs, and sample records. Without this, accuracy achieved during sampling may be lost when production starts.

Finally, watch for revision convergence. Strong OEM projects show smaller, more precise changes with each round. If revisions keep drifting or reopening old issues, manufacturability risk remains high.

| Revision Factor | Weak OEM Behavior | Strong OEM Behavior | Buyer Advantage |

|---|---|---|---|

| Feedback handling | Acknowledges only | Confirms & translates | Fewer misunderstandings |

| Change scope | Broad rework | Targeted adjustments | Stable progress |

| Approval criteria | Emotional judgment | Defined checkpoints | Faster sign-off |

| Change tracking | Informal notes | Updated patterns & BOMs | Production accuracy |

| Revision trend | Repeated drift | Clear convergence | Launch confidence |

For buyers, disciplined revision and approval processes protect both design accuracy and manufacturability. OEM partners who revise with structure, document decisions, and guide approvals make the transition to final materials and production far smoother.

How Materials, Safety Standards, and Compliance Are Finalized Before Production

Before moving into production, OEM projects must lock three elements together: materials, safety standards, and compliance scope. From my experience, this step is where many projects either become production-ready—or get pushed back by re-testing and redesign.

Material finalization starts with production-intended selection, not sample-only substitutes. OEM partners should confirm fabric type, pile length, density, backing stability, and filling specifications based on approved samples. Any late material change, even if “similar,” introduces risk to appearance, feel, and safety outcomes.

Safety standards must be finalized by target market, not by factory habit. Buyers should clearly confirm age grading and applicable regulations (e.g., U.S. or EU), and OEM partners should translate these into concrete design and material decisions—such as embroidered features, reinforced seams, or restricted accessory use. Professional OEM teams proactively flag safety conflicts before testing begins.

Compliance planning also includes testing scope and responsibility. Reliable OEM partners define which tests are required, when samples are submitted, and how test reports link to production materials and construction. This prevents mismatches between tested samples and mass production.

Another critical task is BOM locking (Bill of Materials). Once materials and components are finalized, the BOM should be frozen and version-controlled. This ensures purchasing, production, and QC all reference the same standard.

Finally, documentation readiness matters. Production should not start until material specs, safety intent, test plans, and approvals are aligned and recorded. This discipline protects timelines and reduces post-production risk.

| Finalization Area | Weak OEM Practice | Strong OEM Practice | Buyer Outcome |

|---|---|---|---|

| Material selection | Sample-only substitutes | Production-intended materials | Consistent appearance |

| Safety alignment | Assumed standards | Market-specific design | Faster approvals |

| Testing planning | Reactive testing | Pre-defined test scope | Fewer delays |

| BOM control | Informal lists | Version-controlled BOM | Cost & quality control |

| Documentation | Scattered records | Locked & aligned files | Production readiness |

For buyers, this step is the last line of defense before production risk increases dramatically. OEM partners who lock materials, safety, and compliance together—clearly and early—enable a smooth transition into pre-production alignment and launch planning.

How Pre-Production Alignment and Production Planning Lead to a Successful Launch

Pre-production alignment is the final checkpoint where strategy turns into execution. From my experience, even well-designed OEM projects can fail at launch if production planning and internal alignment are rushed or incomplete. This step ensures that what was approved can be delivered—on time and at scale.

The first priority is cross-team alignment. Design, pattern, purchasing, production, and QC teams must work from the same locked standards: approved sample, final BOM, size specs, tolerance limits, and safety intent. Strong OEM partners hold internal handover meetings to prevent information loss between departments.

Production planning follows alignment. Reliable factories break the order into cutting, sewing, stuffing, finishing, and packing schedules, then match them with labor availability and machine capacity. This planning includes buffers for material arrival, in-line inspection, and potential rework—especially important for new designs.

Material readiness is another key factor. All fabrics, fillings, and accessories must be confirmed, approved, and scheduled before production starts. Experienced OEM partners avoid “produce first, adjust later” behavior because it creates inconsistency and delays.

Pilot or pre-production runs are often used to validate readiness. A small run confirms line balance, workmanship stability, and QC effectiveness before full-scale production. Factories that skip this step often discover issues too late.

Finally, launch success depends on clear communication and monitoring. Buyers should receive production updates, inspection checkpoints, and shipment readiness confirmation. Transparency during production builds confidence and allows early intervention if risks appear.

| Planning Area | Weak OEM Execution | Strong OEM Execution | Buyer Benefit |

|---|---|---|---|

| Internal alignment | Verbal handover | Documented standards | Fewer errors |

| Production scheduling | Rough estimates | Line-based planning | On-time delivery |

| Material readiness | Partial availability | Fully confirmed inputs | Stable quality |

| Pre-production run | Skipped | Pilot validation | Risk reduction |

| Production reporting | Reactive updates | Planned checkpoints | Launch confidence |

For buyers, pre-production alignment is the moment of truth. OEM partners who plan carefully, align teams, and communicate clearly are far more likely to deliver a smooth launch—without last-minute surprises.

Conclusion

Successful OEM development follows a clear process. When preparation, feasibility, sampling, compliance, and production planning align, custom stuffed animals launch faster, scale smoothly, and perform reliably in the market.

📧 Contact: [email protected]

🌐 Visit: https://kinwintoys.com